Table of Contents

i9 Form 2021 – Whether You Are An Employer Or Employee Within The U.S., It is Crucial To Know About The I-9 Form 2021 IRS. There are plenty of forms that must definitely be given, filled in, and maintained when you hire a new employee on their initially day before starting to officially job. One of them will be the I-9 Form 2021 IRS, that is a mandatory file for all new staff as essental to the United States’ federal government.

What Exactly Is i9 Form?

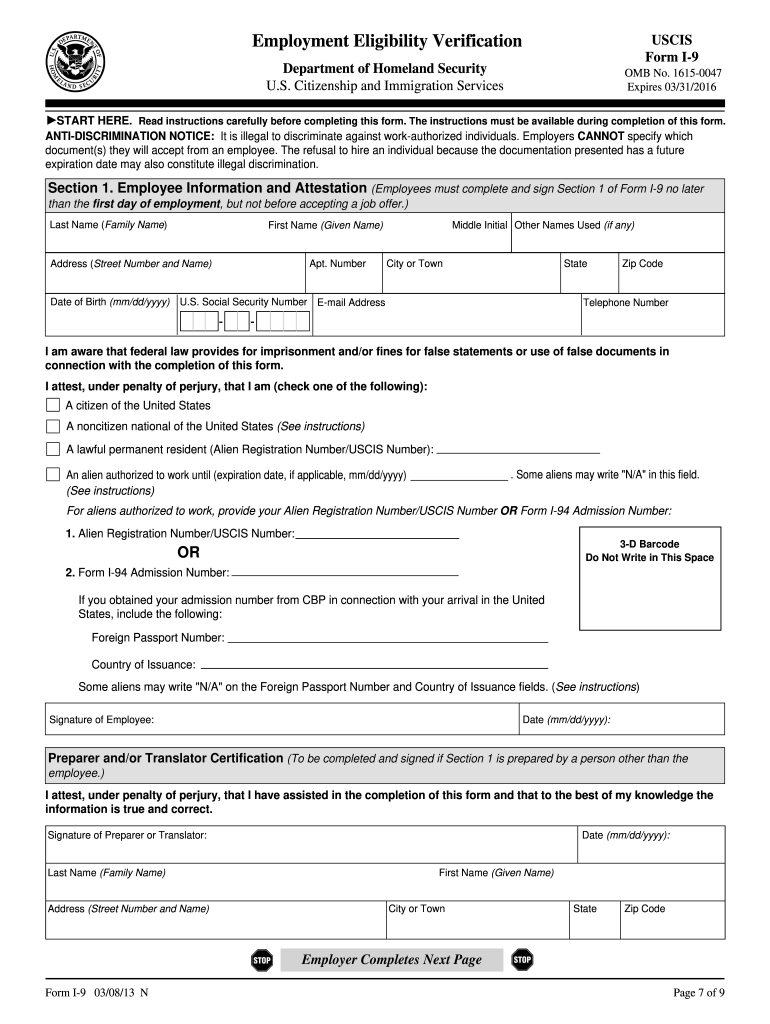

The I-9 Form 2021 IRS is distributed through the U.S. Citizenship and Immigration Services (USCIS), that is one of the agencies underneath the U.S. Department of Homeland Security (DHS). It is formally called as Employment Eligibility Verification form. The record should be done by every and every single new employee to figure out their eligibility to work in the United States.

Any employer inside the United States must provide and have their own new hires complete the form in spite of their citizenship position. This process of accomplishing this record involves both the new employee and the employer. The form of i9 is not needed to become sent in to USCIS or DHS, but it could be required throughout audits, which is often carried out at any given time by U.S. Immigration and Customs Enforcement’s (ICE).

What Paperwork Are Acceptable to Verify I-9 Form?

You will find three documentation categories recognized by USCIS for first time hires to supply, for identification uses. These paperwork are split into List A, List B, and List C.

List A includes documents that are utilized to verify the identity and employment authorization of the employee. Meanwhile, List B consists of files that verify the employee’s identity only, and List C contains paperwork that verify the employee’s job authorization only. For that reason, new hires that provide files of List A, are certainly not necessary files of List B and List C any longer.

When Should I-9 Form Be Filed?

The form of i9 will not be sent to the government organization, as opposed to most of the forms related to employment. This record must be maintained from the employer and needs to be provided in case the ICE agency performs an inspection. All of the employees’ i9 Forms must be retained through the employer if they remain to work for the company or business. In addition, it needs to be retained a minimum of one year following the employment among both sides has arrived to an finish.

The regularity of audits for many different companies continues to be greater from the U.S. ICE agency. That’s why it is very important hold the i9 Forms filled in and kept correctly to prevent acquiring fines and fees and penalties.

What Goes On If I-9 Is Late?

Since the new hires must existing an entirely packed i9 Form in the span of three operating times once they work with the very first day, should they failed to comply with this control, they could be terminated from employment because of this reason.

The procedure of finishing and retaining the i9 Form is essential. The record should be filled in accordingly and correctly, as U.S. Immigration and Customs Enforcement (ICE) company may execute an i9 audit at random instances. Neglecting to comply with the government ask for may lead to you spending big charges and a fine.

Although the I-9 Form 2021 IRS itself is only comprised of two pages, its instruction is comprised of 22 pages. This gives a lot of odds to create blunders. If your business is regarded to constantly practicing offenses as a pattern from the federal government, then you may be exposed to legal penalties or civil penalties, which may influence the cabability to employ employees in the state also.

I-9 Form 2021 IRS Download

Loading...

Loading...