Table of Contents

i9 Form 2021 – If You Are An Employer Or Employee In The U.S., It is Essential To Know About The IRS Forms I 9 2021. There are tons of forms that must definitely be offered, filled out, and managed when you employ a new employee on their initially day prior to starting to officially function. One of them is the IRS Forms I 9 2021, which is actually a necessary document for all new staff as necessary for the United States’ federal government.

What Exactly Is i9 Form?

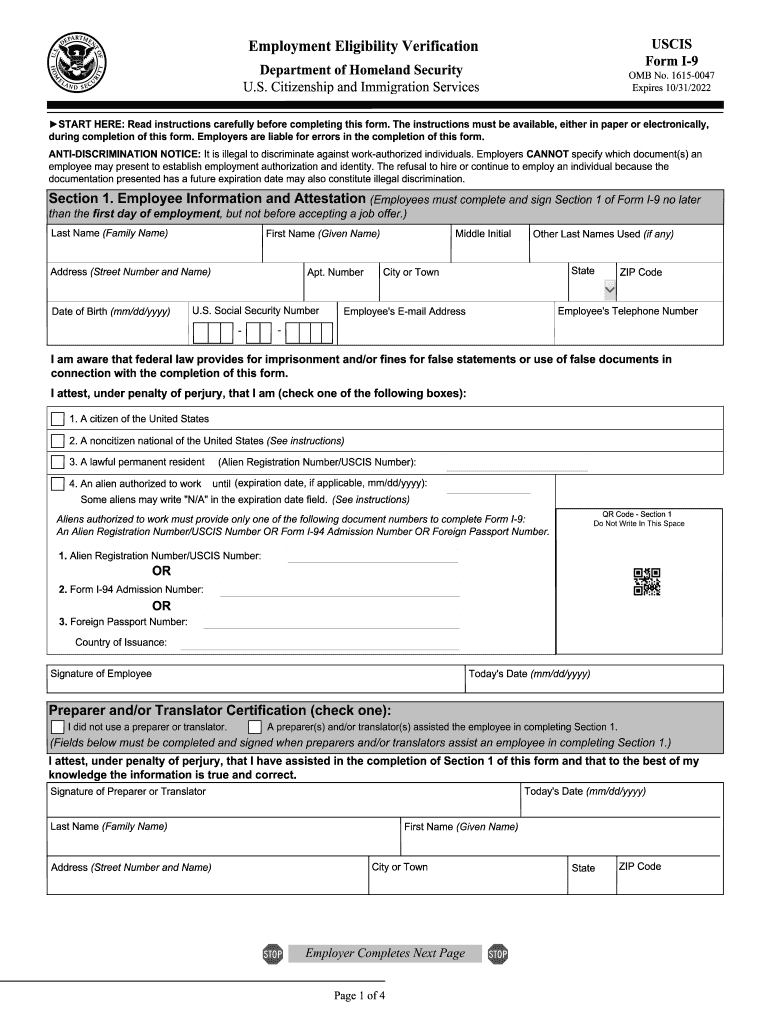

The IRS Forms I 9 2021 is distributed by the U.S. Citizenship and Immigration Services (USCIS), which can be one of the organizations under the U.S. Department of Homeland Security (DHS). It is officially titled as Employment Eligibility Verification form. The document should be completed by every and every new employee to determine their eligibility to work in the United States.

Any employer inside the United States is needed to offer and have their own new hires total the form in spite of their citizenship position. The process of accomplishing this record consists of both new employee and the employer. The form of i9 is not required to get submitted back to USCIS or DHS, but it might be required during audits, which can be done at any moment by U.S. Immigration and Customs Enforcement’s (ICE).

What Files Are Appropriate to Verify I-9 Form?

There are three records categories identified by USCIS for first time hires to offer, for identification purposes. These documents are separated into List A, List B, and List C.

List A consists of documents that are employed to verify the personal identity and employment authorization of the employee. Meanwhile, List B includes paperwork that verify the employee’s personal identity only, and List C consists of documents that verify the employee’s work authorization only. Therefore, new hires that offer documents of List A, usually are not needed paperwork of List B and List C anymore.

When Should I-9 Form Be Submitted?

The form of i9 is not published to the government company, in contrast to most of the forms related to employment. This document should be kept through the employer and ought to be supplied if your ICE company executes an assessment. All of the employees’ i9 Forms must be retained from the employer as long as they remain to get results for the company or enterprise. Additionally, it ought to be retained the absolute minimum of one year right after the employment in between the two of you has come for an conclusion.

The regularity of audits for many different companies has become increased through the U.S. ICE company. That is why it is essential to possess the i9 Forms filled out and held appropriately to stop acquiring penalties and charges.

What Will Happen If I-9 Is Past Due?

Because the new hires must existing a totally packed i9 Form inside the span of three operating days when they work with the first day, if they did not adhere to this regulation, they may be terminated from employment for this reason purpose.

The procedure of finishing and maintaining the i9 Form is very important. The file should be filled in properly and precisely, as U.S. Immigration and Customs Enforcement (ICE) company might carry out an i9 audit at random instances. Failing to adhere to the government request may result in you paying big penalties and a fine.

Even though the IRS Forms I 9 2021 is only comprised of two pages, its training is comprised of 22 pages. This gives so many chances to create errors. If your business is considered to constantly practicing infractions as a routine through the federal government, you might be subjected to legal penalties or civil fees, which might influence the ability to utilize staff inside the state too.

IRS Forms I 9 2021 Download

Loading...

Loading...